End of financial year accounting can be stressful for accountants and finance professionals. With looming deadlines and many complex tasks associated with lease accounting under IFRS 16 (AASB 16), it's crucial to have efficient processes and tools in place.

This article serves as a comprehensive guide for accountants and finance professionals across various industries, equipping them with the knowledge and strategies to navigate the intricacies of IFRS 16, help achieve compliance with lease accounting standards, and streamline lease accounting processes for a smooth close to the end of financial year.

IFRS 16 and end of financial year accounting

IFRS 16 (AASB 16) requires businesses to recognise most leases on the balance sheet. This change necessitates a shift from the traditional operating lease model to a right-of-use asset and lease liability approach, which impacts key financial statements and ratios. IFRS 16 also affects the way lease accounting is handled, often resulting in an increased workload through additional time and effort. However, it is beneficial in the long run as it provides a more accurate picture of a company’s financial performance and contractual commitments.

Key end of financial year accounting considerations

Lease identification. Incomplete or inaccurate lease identification can lead to misstatements in balance sheets. That is why it is crucial to correctly identify and classify all leases, including embedded leases within contracts, and accurately measure lease terms, calculate the present value of lease payments, and make journal entries.

Lease term and payment schedule. Determining the correct lease term and payment schedule is essential for calculating the initial recognition and subsequent measurement of the right-of-use asset and lease liability.

Discount rate selection. Selecting the appropriate discount rate to present the lease liability at its present value is essential for accurate financial reporting.

Subsequent measurement. Understanding the subsequent measurements that have occurred throughout the year concerning the right-of-use asset and lease liability, including modifications and impairments, is essential for maintaining accurate financial records throughout the lease term.

Disclosure requirements. Detailed disclosures about lease arrangements have become mandatory, requiring comprehensive data collection and presentation. It is important to prepare the necessary lease disclosures as outlined in the regulations, including lease payment schedules, lease maturities, and contingent rentals.

Strategies for streamlining your end of financial year

Sufficient preparation

One of the most common mistakes is waiting until the last minute. It is best to begin preparing for the end of financial year and gathering lease data, ensuring its accuracy and completeness, well in advance to avoid last-minute scrambling and potential errors in your accounting

Robust lease inventory

Establish a comprehensive centralised lease location that captures all lease information, including lease agreements, amendments, termination clauses, and any other supporting documents. Maintaining detailed documentation supports lease accounting decisions and calculations, while regular updates to the inventory help ensure its completeness and accuracy, facilitating easy data access and retrieval.

Clear processes

It is helpful to develop internal policies and procedures for lease accounting and management. These policies should outline the steps for identifying leases, classifying them, determining discount rates, and managing subsequent measurements.

Effective communication and collaboration

Foster open, transparent and well-documented communication between accounting teams and other departments involved in leasing activities. This promotes timely information exchange, facilitates accurate lease data collection, and minimises the risk of errors. Engaging key stakeholders and involving relevant departments such as finance, legal and procurement in the lease identification and data collection process can also help with lease accounting decisions and procedures.

Monitoring and improvement

Regular reviews of the company’s lease information help ensure the accuracy and completeness of its lease data throughout the year, not just during the end of financial year. Similarly, continuously evaluating the existing lease accounting and management practices can help identify inefficiencies and make improvements that will help save time, reduce costs and result in more effective end of financial year accounting.

.png?width=2000&height=1500&name=Nomos%20One%20(3).png)

Leveraging technology for a streamlined end of financial year

In the digital age, technology is a powerful ally for lease accounting and management. Tech solutions can assist in centralising lease data for easier access and reporting, automating complex calculations, and achieving compliance with IFRS 16. Utilising specialised lease accounting software and automation tools has the potential to significantly streamline processes, minimise errors, enhance visibility into lease portfolios, and, as a result, simplify year-end lease accounting. Look for software that offers:

-

Accurate lease calculations. Ensure precise calculations of lease payments, present value, and depreciation based on complex lease terms.

-

Critical date alerts. Never miss a deadline with automated reminders and notifications for important lease events.

-

Integrated reporting and disclosure. Generate compliant and comprehensive disclosures for inclusion in financial statements.

-

Data visualisation and analytics. Gain valuable insights into your lease portfolio and make informed financial decisions.

This technological integration enables organisations to manage leases more efficiently, from tracking lease terms to generating compliance reports, freeing up resources for other critical activities. However, it is also important to regularly evaluate your technology, assess the effectiveness of your chosen lease accounting software, and explore potential improvements and upgrades that can be made.

Additional considerations for a successful end of financial year

Staying informed

It is highly beneficial to stay updated on the latest interpretations and pronouncements related to IFRS 16 (AASB 16) to ensure ongoing compliance. Keep abreast of regulatory changes or updates to standards and requirements and adapt your processes accordingly.

Seeking professional guidance

When faced with complex lease scenarios and interpretations or complicated lease accounting matters, do not hesitate to consult with internal auditors or specialised financial advisors from qualified accountants.

Partnering with experts

Consider partnering with a professional advisor specialising in IFRS 16 (AASB 16) for guidance and support throughout the year, particularly during the end of financial year close.

By proactively addressing the critical aspects of end of financial year accounting and implementing the strategies outlined above, accountants and finance professionals can navigate the year-end with confidence, even amidst the complexities of the IFRS 16 framework.

Utilising technology solutions and seeking professional guidance when necessary can further alleviate the burden and help achieve compliance with the current lease accounting standards. A smooth and efficient end of financial year process under IFRS 16 sets the stage for continued accuracy and transparency in financial reporting throughout the upcoming year.

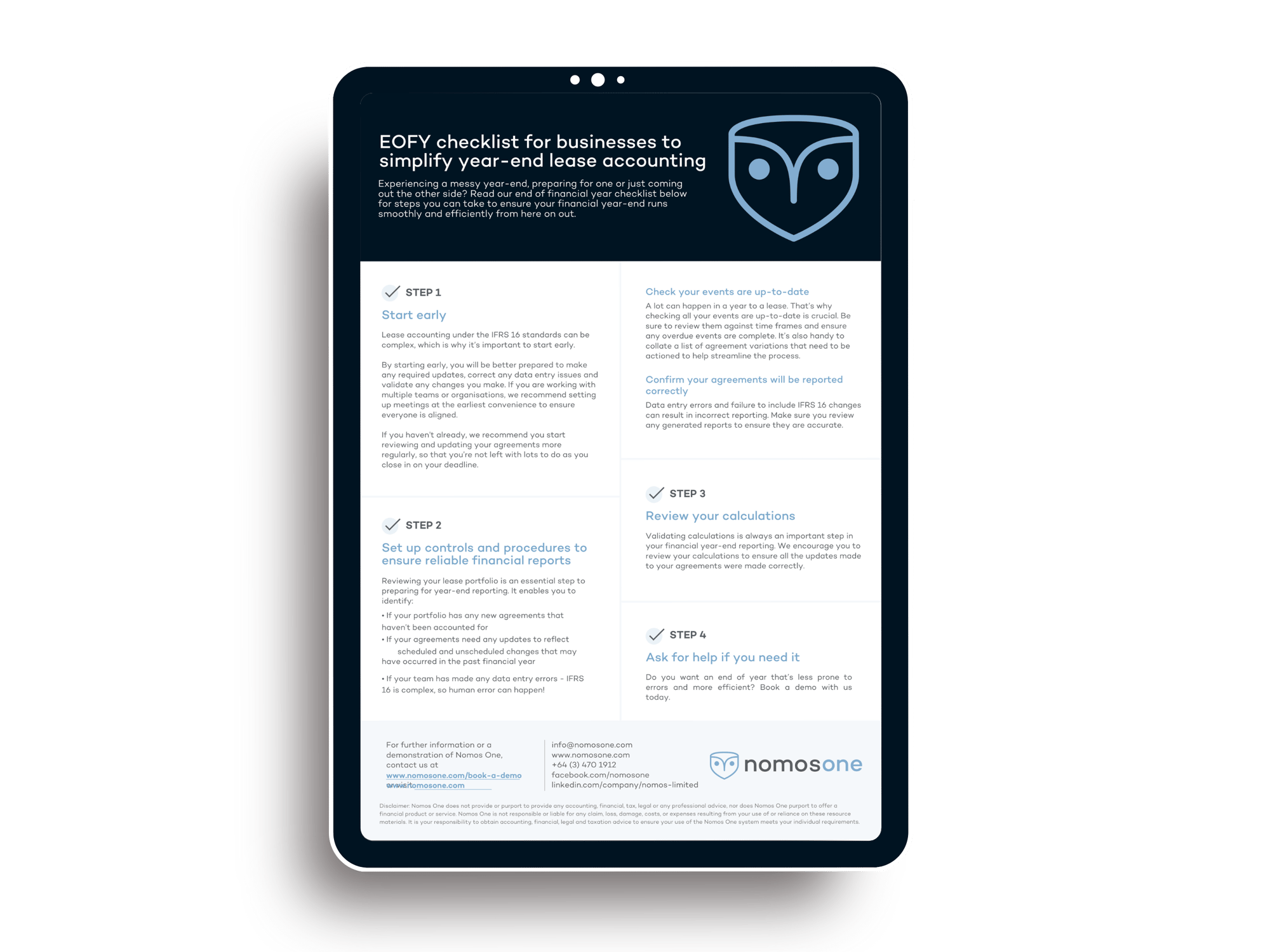

Want more tips on simplifying year-end lease accounting? Download our EOFY Checklist for Businesses!

Disclaimer: This article provides a general overview. Consult with professional advisors for specific guidance and compliance requirements.