Leasing of assets is a common practice among businesses, allowing them to provide or obtain equipment, machinery, or vehicles at a more affordable rate compared to paying the full cost upfront. This can be beneficial for organisations that need to conserve their cash flow, want to avoid the risks associated with owning an asset, or would like more flexibility.

After the introduction of IFRS 16, lease management evolved significantly, requiring asset management teams and finance teams to work together to ensure compliance with the accounting standard. It is now important for organisations that lease assets to provide detailed accounts of their leases, which includes recording and reporting lease-related transactions in the company's financial statements.

When accounting for leases, an organisation is required to recognise lease assets and liabilities on its balance sheet. The main purpose of lease accounting is to provide investors and other stakeholders with a clearer picture of a company's financial position and the long-term obligations it has related to its leased assets.

When accounting for leases, there are several key considerations that organisations need to keep in mind. These considerations help ensure compliance with the applicable lease accounting standards, such as IFRS 16.

Here are the main factors to consider:

Lease term

When accounting for leases, it’s important to determine the lease term, including the non-cancellable period of the lease and any additional periods covered by options to extend or terminate the lease if the lessee is reasonably certain to exercise those options. The lease term is used to calculate the lease liability and the right-of-use asset.

Lease payments

Identify and properly account for all lease payments, including fixed payments, variable payments, or options to purchase the asset. Variable lease payments that depend on an index or rate need to be estimated and included in the measurement of the lease liability.

Discount rate

Determine the appropriate discount rate to calculate the present value of lease payments. The discount rate should reflect the interest rate implicit in the lease, but if it is not readily determinable, the lessee should use its incremental borrowing rate.

Right-of-Use (ROU) Asset

Recognise a right-of-use asset on the balance sheet for all leases. The ROU asset represents the lessee's right to use the leased asset during the lease term.

Lease liability

Recognise a lease liability on the balance sheet, representing the lessee's obligation to make lease payments over the lease term. The lease liability is initially measured at the present value of lease payments and subsequently adjusted for interest and lease modifications.

Lease modifications

Evaluate the accounting treatment for lease modifications, such as changes in the lease term, lease payments, or lease scope. Modifications may require a reassessment of lease liability and ROU asset values and adjustments to the lease accounting.

Disclosures

When you’re accounting for leases, ensure proper disclosure of lease-related information in the financial statements. Disclosures should provide information about the nature of the leases, future lease payments, maturity analysis of lease liabilities, as well as significant judgments and assumptions used in lease accounting.

Transition and implementation

For organisations adopting the lease accounting standards, careful consideration should be given to the transition approach and implementation plans to ensure a smooth and accurate transition to the new accounting requirements. This may involve retrospective application or modified retrospective application, depending on the chosen transition approach.

Although not exhaustive, these considerations are essential for accurately accounting for leases and complying with the applicable lease accounting standards, such as IFRS 16 (AASB 16). However, for specific guidance, a company should refer to the standard itself or consult with an accounting professional to ensure adherence to guidelines.

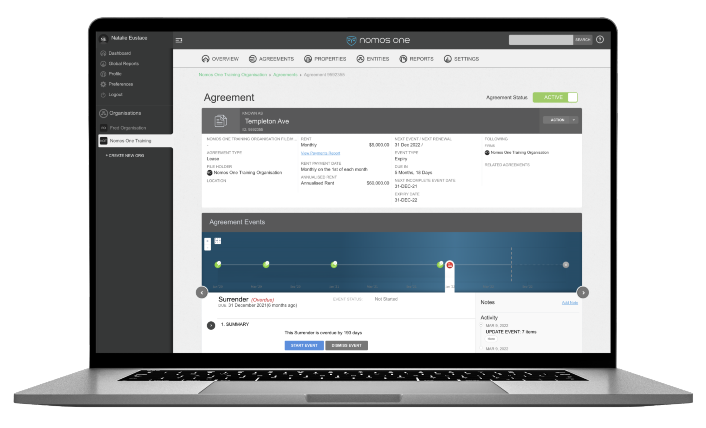

Implementing IFRS 16 software that is designed for managing different assets could significantly streamline and simplify lease management and lease accounting. Adopting a robust lease accounting and lease management system may help an organisation reduce commercial lease costs, boost ROI, avoid errors and increase efficiency.

With over a decade of experience supporting customers from a variety of sectors (including utilities, healthcare, education, and local council), Nomos One covers and manages many aspects of the lease cycle, enabling clients to easily manage hundreds of leases on one platform.

Book a demo to discover how our software can make lease accounting and lease management effortless and enjoyable!