IFRS 16 is complicated. When it comes time to review your balance sheet and profit and loss accounts at the end of the reporting period, it can be challenging to get an intuitive feel for how these numbers are made up. This isn’t surprising, as up to 50 different components can be included in an individual lease agreement calculation, and this is before we start accounting for any changes to this information.

That’s why we have put together the three most important reasons your team needs to include the Daily Calculation Report (DCR) as part of your Nomos One lease accounting toolkit.

Getting to grips with the detail

The DCR uses the language of accountants to establish precisely how each balance sheet and profit and loss account is calculated over every day of the lease. This spreadsheet uses formulas & cell referencing to give the entire financial model of the lease for the information currently entered through the agreement.

This allows users to get in behind the numbers and see how their balance sheet accounts are calculated at a time that otherwise would be a number on a screen.

Understanding the payment series (the bread & butter of lease accounting)

If you want to understand something, first you need to understand its underlying mechanics.

The mechanics of lease accounting all come down to the payment series. The payment series is the projected lease payments extending over the expected life of the lease, and these payments are then discounted back to reflect the lease liability.

As the payment series extends into the future, assumptions have to be made around what the rent might be when there are lease events such as CPI rent reviews, market rent reviews etc. New information is added to the model as the future becomes the present. Adjustments are made to the payment series to reflect the actual rent amounts agreed upon following the market rent review (for example).

The DCR has a tab showing all of the different payment series that have been active at various points during a lease’s life. This allows a user to quickly check changes made to the payment series and review that the current payment series makes sense.

Our Head of Professional Services, Natasha Bull, shares some top tips for property and lease managers to better understand IFRS 16 property leases.

If you’re not working in accounting, you probably haven’t heard much about IFRS 16. Still, if you’re a lease administrator or property manager, your day-to-day job now significantly impacts your business’s balance sheet. IFRS 16 doesn’t fall squarely on accountants’ laps – it’s a collaboration between property and finance, as it requires both teams to play their roles perfectly to achieve the right outcomes.

For us non-accountants, the idea of new lease accounting standards seems daunting and confusing before you’ve even read the paper's title. The standard can be broken down into two basic principles (don’t worry, accountants – we know it’s more complex than this).

Right of Use Asset (ROUA)

How long you’re allowed to be in the property, or how long you can lease the vehicle.

Lease Liability (LL)

How much money you need to pay equates to how long you will be in the property or lease a vehicle.

As you pay rent, your liability goes down, as does your right to use the asset. Easy right?

The question now is, what can the property team do to work with their accounting teams to ensure that they’re reporting on the correct information?

Managing your IFRS 16 property leases is more important than ever

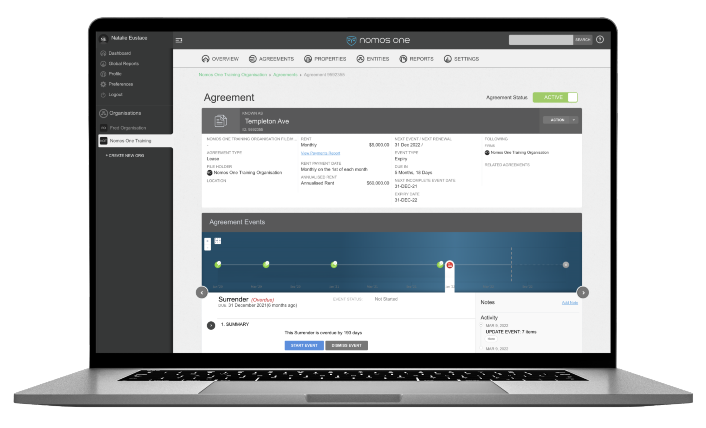

Ensuring that rent is up to date, renewals are actioned within the appropriate timeframes and that variations to initial deeds of lease impact the Right of Use and the Lease Liability profile of your business. Nomos One has reports available to show you what events are upcoming or overdue, and we can work with you to set up email alerts when these events are months in advance so you never miss an important date.

Make month-end easier for your accountants

Accountants work to strict deadlines; take it from the Nomos One Support team! The month ends and the end of the financial year are some of the most stressful times of the accounting calendar. Talk to your accountants about their closing process and work with them to get all updates done to the portfolio by then. Making changes after close can result in books not balancing, manual journal entries, additional reconciliations, and many headaches. They’ll love you for it!

Add your flare to the system

IFRS 16, as we’ve learnt above, isn’t just for accountants. It would be best to incorporate your workflows and processes into the software as a property team so you get bang for your buck. Customising the solution to fit the dual needs of property and accounting will make for happy teams all around when managing IFRS 16 property leases.