The IFRS 16 lease accounting standard plays a crucial role in maintaining financial transparency and ensuring accurate reporting for businesses. The standard has unquestionably resulted in substantial transformations for businesses and small to medium-sized enterprises. While it improves clarity and offers a more precise portrayal of lease commitments, it also presents operational, strategic, and financial difficulties.

By proactively acknowledging and dealing with the effects of IFRS 16, businesses and SMEs can effectively manage these alterations, guarantee compliance, and uphold open and transparent communication with stakeholders.

Let’s explore the main ways in which the IFRS 16 lease accounting standard impacts businesses and SMEs.

Financial reporting changes and increased transparency

IFRS 16 significantly impacts how businesses and SMEs report their financial statements. One of the most notable changes introduced by the lease accounting standard is the recognition of operating lease obligations on the balance sheet. Previously, operating leases were generally kept off-balance sheets, which could distort a company's financial position and make it difficult for stakeholders to assess its true financial position. With the implementation of IFRS 16, businesses and SMEs now have enhanced balance sheet visibility, as they are required to recognise lease liabilities and corresponding right-of-use assets.

This increased transparency provides a more accurate representation of a company's financial obligations. It also allows investors and stakeholders to better understand a company's lease commitments, providing them with better insights into its financial health and risk profile.

Impact on financial ratios and key performance indicators

When accounting for leases, it is important for companies to have an in-depth understanding of IFRS 16, as this change can have a significant impact on a company's financial ratios, such as leverage ratios and return on assets, as well as key performance indicators. The lease accounting standard can also affect various KPIs businesses and SMEs use to assess their performance. For instance, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) may increase as operating lease expenses are replaced by depreciation and interest expense. This change also impacts the comparability of financial performance across different periods.

Increased disclosure requirements

IFRS 16 introduces more extensive disclosure requirements for businesses and SMEs. The lease accounting standard mandates the disclosure of lease commitments, significant judgments made in applying the standard, and additional qualitative and quantitative information related to leases. These requirements ensure that stakeholders have access to relevant information to assess the impact of leases on a company's financial position and performance. SMEs may find these additional disclosure requirements challenging due to limited resources and expertise, necessitating additional efforts to comply with the standard.

.png?width=2000&height=1500&name=Nomos%20FB%20%20IN%20Templates%20(2).png)

Potential tax and legal implications

The IFRS 16 tax impact may be significant for businesses and SMEs. For example, changes in the recognition and measurement of lease assets and liabilities can impact tax calculations, deductions, and compliance requirements. Furthermore, the revised lease accounting standards may trigger contractual and legal considerations, such as loan covenants, debt agreements, or lease renegotiations.

Operational and strategic considerations

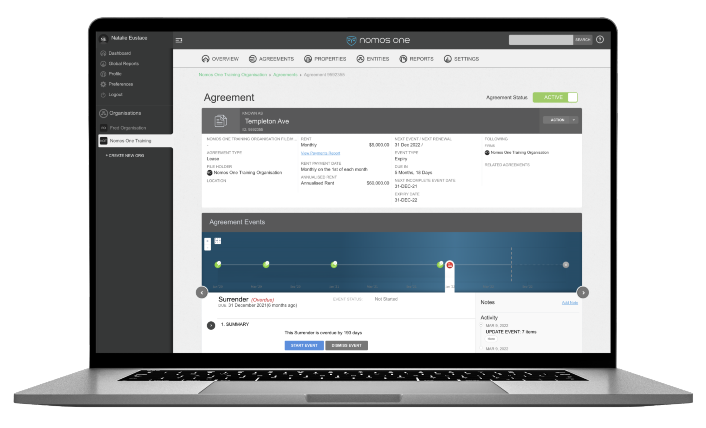

Beyond the financial impact, IFRS 16 also has operational and strategic implications, necessitating changes in lease management and contract administration processes. Businesses and SMEs need to establish robust lease accounting systems and processes and invest in resources to help them effectively capture, track, measure, manage, and report lease-related information.

Additionally, the standard may influence leasing decisions and strategies, so businesses and SMEs should consider the impact of IFRS 16 on lease-versus-buy decisions, negotiation strategies, and overall lease portfolio management.

It is important to note that the specific impact of IFRS 16 can also vary depending on the size, industry, and individual circumstances of a business or SME. Therefore, consulting with lease accounting professionals or financial advisors for a comprehensive analysis of your situation's implications is advisable.

To conclude, in order to better navigate the impacts of IFRS 16, organisations should not only have knowledge of the standard itself, but also implement effective lease management practices, such as maintaining an up-to-date lease register, monitoring lease terms, and complying with lease covenants.

One step towards this is adopting a cloud-based lease management and lease accounting solution, such as Nomos One. Its centralised repository, customisable reports and workflow automation features can significantly simplify the tasks involved in lease management and IFRS 16 accounting.

In addition, our expert customer support team and in-house technical accountants can help with training (which may be subject to an additional cost) or any questions you may have.

Contact us if you would like to learn more!